Making access to medical insurance for France, Benelux or Monaco simpler, easier and safer

If you’re part of the caisse primaire d’assurance maladie (the French statutory health insurance scheme), our Expat Protect plans top-up your cover, bridging the gap between state and private insurance. If you’re not part of the scheme, you can rest easy, knowing that you have comprehensive private health insurance to protect you and your loved ones.

View our guides on healthcare in:

The expatriate health insurance

cover includes

Doctor visits

Hospitalization

Vaccinations

Surgeries

Diagnostic tests

Prescription drugs

Cancer treatment

Option to add a repatriation plan

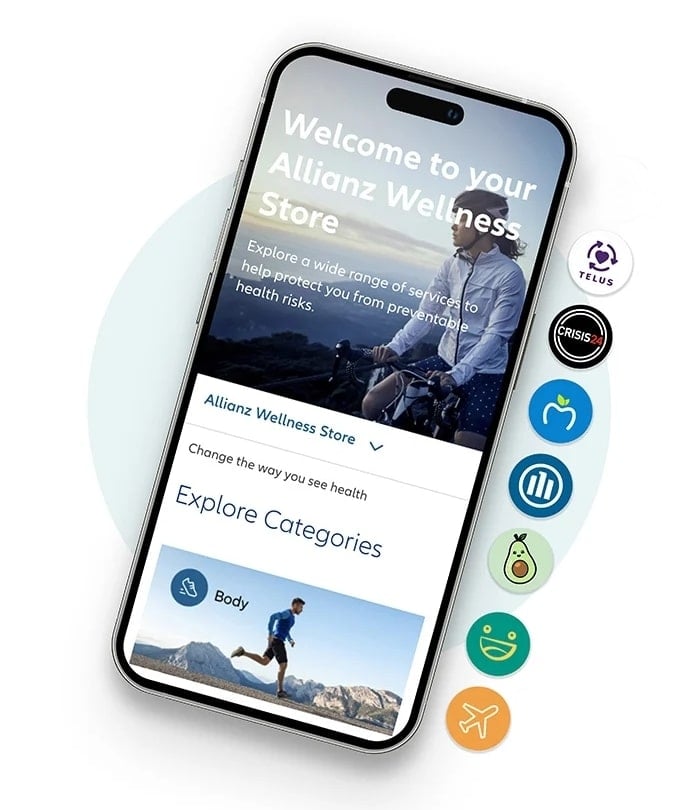

International Health Insurance Services included with your cover

You have access to a range of services gathered in one convenient hub to help protect you and your family from preventable health risks. Our services include Telehealth, Expat assistance programme, Mental health app, Fitness coaching App, Nutrition Hub, Travel Security and more.

The ratings provided are based on recent reviews from individuals in your region who utilise the same type of device as you. Please note that these ratings may not reflect the experiences of all users and are subject to change over time. Individual experiences may vary.

Expat Protect plans at a glance

Pack

Premium

€3,000,000

| Private Room | ✓ |

In-patient / Day-care |

✓ |

Prescribed drugs / Over-the-counter drugs |

€50 |

Nursing at home or in a convalescent home |

✓ |

Rehabilitation treatment |

✓ |

| Maternity | €10,000 per pregnancy |

Pack

Confort

| Semi-private Room | ✓ |

In-patient / Day-care |

✓ |

Prescribed drugs / Over-the-counter drugs |

X |

Nursing at home or in a convalescent home |

€4,250 |

Rehabilitation treatment |

€4,250 |

| Maternity | €7,000 per pregnancy |

Enhance Your Cover with Optional Plans

Out-patient plan

Dental plan

Repatriation plan

Ready to get your cover?

If you have a question, would like to learn more, or if you just want to chat through your options, our International Health team are here to help. Call us on +353 1 514 8480 or email us.

Why choose us as your trusted international health insurer?

#1

Best in class experiences

Financially strong company with A+ Superior, A.M. Best rating. Number 1 insurance brand by Interbrand for the seventh year running.

2M+

Worldwide expertise

Growing network of over 2 million quality medical providers, settling medical bills directly with the provider for most in-patient treatments.

24/7

Support

Always on: 24/7 multilingual Helpline and Emergency Assistance Services.

48hrs

Quick and efficient

Fully completed medical claims processed within 48 hours.

Looking for a different insurance solution?

Frequently Asked Questions

What is a geographical area of cover?

For example, if your area of cover is “Worldwide”, this means that your cover will be valid everywhere in the world. If your area of cover is “Africa”, then your cover will be valid everywhere in Africa

*Our policies don’t provide any cover or benefit for any business or activity to the extent that either the cover or benefit or the underlying business or activity would violate any applicable sanction law or regulations of the United Nations, the European Union or any other applicable economic or trade sanction law or regulations. The areas of cover are subject to your policy terms and conditions.

What do you mean by emergency cover outside the chosen region of cover?

If my plan is a top-up to the CFE in France, how do I claim?

- all claims incurred in France and

- all ‘out-of-pocket’ medical expenses incurred outside of France.

My Expat Life

Real stories, real people

Awards and Recognition

ITIJ Award Winner

International Travel and Health Insurer of the Year.

EFMA & Accenture Innovation in Insurance Awards Win

EFMA & Accenture Innovation in Insurance Awards 2022.

UK Health & Protection Award Win

Best International Group Health Insurance Provider 2023.

Already a member?

Certain services that may be included in your plan are provided by third party providers. If included in your plan, these services will show in your Table of Benefits. These services are made available to you subject to your acceptance of your policy’s terms and conditions, as well as the service’s terms and conditions as set out by the relevant third party service provider. By accepting the third party service providers’ terms and conditions, you enter a separate contractual relationship directly with them. Their services may be subject to geographical restrictions. Full details of the third party service providers’ terms and conditions are available in their websites and in the relevant application and/or platform where services may be hosted. The third party service providers are independent data controllers, and we recommend that you review their privacy notices to understand how they process your personal data. The third party service providers offer non-insurance services that are not intended to be a substitute for in-person medical consultations, diagnosis, treatment, assessment or care. You understand and agree that the insurer, its reinsurer and their administrators are not responsible or liable for any claim, loss or damage, directly or indirectly resulting from your use of any of these third party services.