Expat health insurance for Switzerland: cover while living abroad or at home

Our international health insurance plans for Switzerland provide top-up cover to the mandatory Swiss Health Insurance – to cover you when you are in Switzerland and when you are away.

Our expat health insurance for Switzerland includes cover for a wide range of in-patient and day-care treatments as well as an optional level of cover such as out-patient, dental, maternity and repatriation benefits. Our plans also include treatment for Covid-19.

Your cover is also subject to:

- Policy definitions and exclusions

- Any special conditions shown on your Insurance Certificate (and on the Special Condition Form issued before the policy comes into effect, where relevant).

- Any policy endorsements, policy terms and conditions and any other legal requirements.

- Costs being reasonable and customary in accordance with country of treatment, standard and generally accepted medical procedures. If we consider a claim to be inappropriate, we reserve the right to decline or reduce the amount we pay.

Sanctions suspension clause:

Any benefits, cover and claims payments are suspended if any element of the cover, benefit, activity, business, or underlying business exposes us to:

- any applicable sanction, prohibition or restriction under the United Nations’ resolutions, or

- the trade or economic sanctions, laws or regulations of the European Union, United Kingdom, or United States of America.

The above suspension will continue until such time as we are no longer exposed to any such sanction, prohibition, or restriction.

The expatriate health insurance

cover includes

Doctor visits

Hospitalization

Vaccinations

Surgeries

Diagnostic tests

Prescription drugs

Cancer treatment

Option to add a repatriation plan

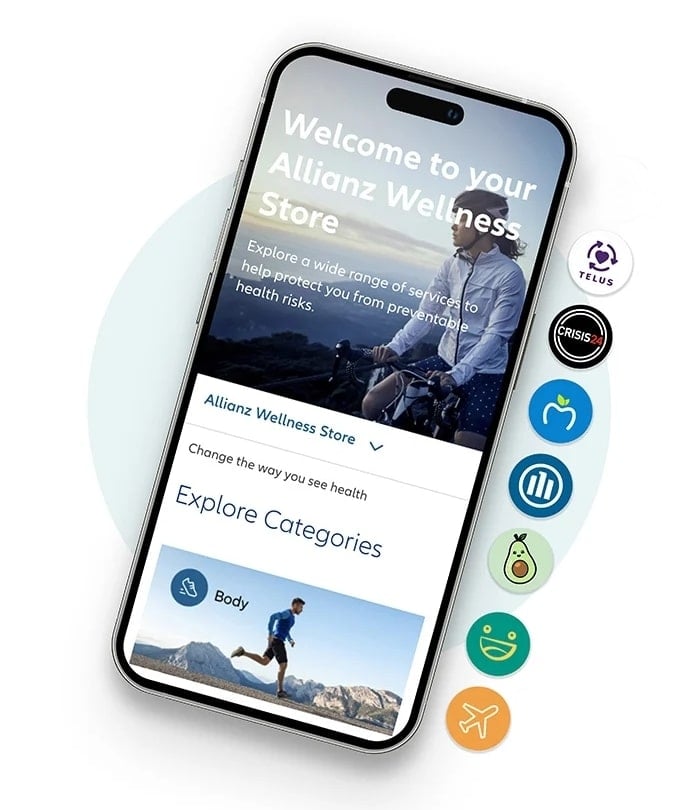

International Health Insurance Services included with your cover

You have access to a range of services gathered in one convenient hub to help protect you and your family from preventable health risks. Our services include Telehealth, Expat assistance programme, Mental health app, Fitness coaching App, Nutrition Hub, Travel Security and more.

The ratings provided are based on recent reviews from individuals in your region who utilise the same type of device as you. Please note that these ratings may not reflect the experiences of all users and are subject to change over time. Individual experiences may vary.

International Health Insurance for Switzerland at a glance

Our core plan options include a comprehensive selection of in-patient benefits and day-care such as hospital accommodation, surgery, medical evacuation and much more.

All our core plans include a selection of Global Health Services that aim to improve the quality of your life.

Provides multi-country cover so you can use your medical cover in any country included within your chosen area of cover. It is a good idea to select an area where you normally travel to or are live for more than 6 months of the year.

Terms and conditions and regulatory restrictions apply.

Premier Individual

CHF 2,925,000

| Private room | ✓ |

Diagnostic tests |

✓ |

Oncology |

✓ |

Rehabilitation treatment |

CHF 5,750 |

Emergency out-patient treatment |

CHF 975 |

| Emergency out-patient dental treatment | CHF 975 |

Maternity plan option available |

✓ |

Where these benefit amounts are reached, any additional costs may be reimbursed within the terms of any separate Out-patient Plan

Where these benefit amounts are reached, any additional costs may be reimbursed within the terms of any separate Dental Plan. In-patient and day-care treatment only

Club Individual

| Private room | ✓ |

Diagnostic tests |

✓ |

Oncology |

✓ |

Rehabilitation treatment |

CHF 3,900 |

Emergency out-patient treatment |

CHF 975 |

| Emergency out-patient dental treatment | CHF 650 |

Maternity plan option available |

✓ |

In-patient, day-care and out-patient treatment; must commence within 14 days of discharge after the acute medical and/or surgical treatment ceases

Where these benefit amounts are reached, any additional costs may be reimbursed within the terms of any separate Out-patient Plan Where these benefit amounts are reached, any additional costs may be reimbursed within the terms of any separate Dental Plan. In-patient and day-care treatment onlyEnhance Your Cover with Optional Plans

Out-patient plan

Repatriation plan

Dental plan

Maternity plan

Looking for a student plan?

If you are an International students studying in Switzerland, our ScoreStudies product may be the right solution for you.

Ready to get your cover?

Call us on +353 1 514 8480 or email us.

Why choose us as your trusted international health insurer?

#1

Best in class experiences

Financially strong company with A+ Superior, A.M. Best rating. Number 1 insurance brand by Interbrand for the seventh year running.

2M+

Worldwide expertise

Growing network of over 2 million quality medical providers, settling medical bills directly with the provider for most in-patient treatments.

24/7

Support

Always on: 24/7 multilingual Helpline and Emergency Assistance Services.

48hrs

Quick and efficient

Fully completed medical claims processed within 48 hours.

Looking for a different insurance solution?

Frequently Asked Questions

In which countries can I receive treatment?

If the eligible treatment is not available locally, and your cover includes “Medical evacuation”, we will also cover travel costs to the nearest suitable medical facility. To claim for medical and travel expenses incurred in these circumstances, you will need to complete and submit the Pre-authorisation Form before travelling.

You are covered for eligible costs incurred in your home country, provided that your home country is in your area of cover.

I am looking for insurance for children. Are my children automatically covered when I sign up?

What is the length of the contract? If I pay monthly, can I cancel at any time?

For all products, there is a 30 day cooling off period from the start date. After this, the policy may not be cancelled until renewal, regardless of whether a monthly or annual payment frequency is chosen. For more information please contact our dedicated sales team on +353 1 514 8480.

My Expat Life

Real stories, real people

Awards and Recognition

ITIJ Award Winner

International Travel and Health Insurer of the Year.

EFMA & Accenture Innovation in Insurance Awards Win

EFMA & Accenture Innovation in Insurance Awards 2022.

UK Health & Protection Award Win

Best International Group Health Insurance Provider 2023.

Already a member?

Certain services that may be included in your plan are provided by third party providers. If included in your plan, these services will show in your Table of Benefits. These services are made available to you subject to your acceptance of your policy’s terms and conditions, as well as the service’s terms and conditions as set out by the relevant third party service provider. By accepting the third party service providers’ terms and conditions, you enter a separate contractual relationship directly with them. Their services may be subject to geographical restrictions. Full details of the third party service providers’ terms and conditions are available in their websites and in the relevant application and/or platform where services may be hosted. The third party service providers are independent data controllers, and we recommend that you review their privacy notices to understand how they process your personal data. The third party service providers offer non-insurance services that are not intended to be a substitute for in-person medical consultations, diagnosis, treatment, assessment or care. You understand and agree that the insurer, its reinsurer and their administrators are not responsible or liable for any claim, loss or damage, directly or indirectly resulting from your use of any of these third party services.